Canara Bank Fixed Deposit

Canara Bank offers NRO Fixed deposit interest rates to NRI customers from 1 year to 5 plus years. Find Canara Bank FD interest for NRO customer from below list. Canara Bank provides different services to its customers some of them are Home loan, Personal loan, Car loan, Two Wheeler loan, Gold loan. Canara Bank fixed deposit is a great way to save money for a period of time, if you are looking at getting your invested money safely along with good returns on your investment, then fixed deposit.

Money is the thing for which we all work day and night, it the basic necessity for us to survive in this world. We all have money with us and we all try to increase the amount of money which we have with us by investing it. And when it comes to invest our money somewhere there are number of place where you can invest and get your money almost doubled but the thing is the risk level which is very high these days. If you want to invest your money in Stock marker, you can really make good amount of money but the risk level is very high in Stock market if you don’t invest in on the right stocks.

But Fixed deposits is the only way where your money will grow with time with risk level which is almost equal to zero. So fixed deposits are very good for us to increase the money we have with us. But if you want to break Fixed deposit in Canara Bank which you have made there and searching online for an article online in which you will find information regarding how you can make premature withdrawal of your fixed deposit. Then you have landed on the right website. Because in this guide you will find information about this.

Contents

What is Premature Withdrawal of Fixed Deposit?

But before that I would like to tell you about what is Premature withdrawal actually is? So here is the answer. It is nothing but when you have made a Fixed Deposit for some tenure and you want to withdraw the amount before your fixed deposit gets matured. For example you have made a FD of 1 Lakh INR for a tenure of 12 months (1 Year) and now you want to withdraw your money which which is 1 Lakh INR before 1 year period. This process of withdrawal of money before the actual tenure of FD is called as Premature withdrawal of Fixed Deposit.

How to Break Fixed Deposit in Canara Bank?

So now lets get started with this guide and check out the procedure which you need to follow to break fixed deposit in Canara Bank. The process is very easy and you can do it with few steps, I have mentioned them below.

- The first thing you need to do is you have to write a application to your branch manager regarding the Premature withdrawal of your FD. You can refer the letter sample which I have mentioned below.

To:

Branch Manager,

Canara Bank,

Camp, Belgaum

Subject: Premature Withdrawal of Fixed Deposit.

See Full List On Canarabank.com

Respected Sir,

I am Subhash Sharma and I had opened a FD in your branch on 01/06/2016 whose tenure was of 1 year but I want to withdraw the money now. My FD Number is 0000-0000-0000 I request you to break my FD and deposit the money to my Savings Bank account Number XXXX-XXXX-XXXX-XXXX.

Canara Bank Fixed Deposit Form

Canara Bank Deposit Rates

I have attached the my PAN Card photocopy as my Identity proof with this application.

Regards,

Subhash Sharma

- As soon as you complete writing this application to your Canara Bank branch manager now you need to take a photocopy of your PAN Card and make your signature on the photocopy and attach it with the application form.

- Now at last you need to visit your home branch where you had opened your FD and submit your form. And you are done with it.

Note: When you break your FD before it tenure is completed, a penalty will be applied to you. You can ask for the penalty amount which is applied on you at your home branch. Some banks don’t apply penalty and some apply it.

Final Words.

So this was all about how you can break fixed deposit in Canara bank. I hope you are clear with all the steps which I have mentioned in this guide. If you have any kind of doubts you can comment below.

IN THIS ARTICLE

Earn more from your earnings by saving in Canara Bank deposits. The deposits can be made for a short period or for a long period. The tax saving deposits with longer locking period, save you from paying tax on interest earned on the deposit. On the other hand, senior citizens can enjoy 0.5% extra interest on their deposits.Benefits of having Canara Bank Accounts are high when compared to other bank accounts.

You Can Also Check Here For Better Banking Experience

Canara Bank Deposits

Canara Bank provides a wide variety of deposits than the regular fixed deposit. The Ashraya deposit scheme for senior citizens who are aged above 60 years can be opened either singly or jointly. In the case of a joint deposit, the other depositor can be below 60 years of age, however, the senior citizen is the prime depositor. As with the fixed deposit, the ashraya deposit also allows the depositor to take a loan on the deposit. The recurring deposits are those that are paid monthly and are perfect for individuals who wish to make small savings regularly. The minimum amount of RD can be Rs.50 per month and there is no maximum limit. The deposit tenure ranges from 6 months to 120 months. You can withdraw your money with the help of Canara Bank Debit Cards with out visiting the bank. Nomination facility and loan facility is provided along with the deposit. The kamadhenu deposit is the re-investment deposit in which the interest is paid only after the maturity period. The Canara Bank champ deposit scheme is for children aged below 12 years. The Canara Dhanavarsha scheme is another type of recurring deposit beneficial for people planning to deposit Rs.1000 per month. The maximum amount that can be deposited is limited to Rs.1 lac.

Canara Bank Fixed Deposits

Canara Bank Fixed deposit can be opened jointly (with not more than 4 people) or individually. The deposit can also be opened for a minor by a guardian. Partnership companies and other organizations can also make a fixed deposit. The minimum amount has to Rs.1000 with no limit on the maximum deposit. The tenure for the fixed deposit can be as low as 15 days to a maximum of 120 months. Fixed deposits with a very short tenure of fewer than 15 days can also be opened but the limit of the amount is 5 lakhs. TDS is deducted on the interest gained. Customers are given the opportunity to include a nominee for the deposit. A loan of about 90% of the deposit value can be taken. A penalty of 1 % has to be paid for premature withdrawal of the deposit. The deposit amount can be broken into units of Rs.1000 and can be withdrawn as per the requirement. As a result, the depositor will lose interest only on a small portion of the deposit amount. Other Banks like HDFC Bank Deposits, SBI Bank Deposits and Union Bank Of India Deposits also providing different type of Deposits same as the Bank of Baroda.The deposit will be renewed automatically after the date of maturity for the same period as existing. If the customer fails to renew the deposit or withdraw the deposit amount after maturity, the deposited amount will be paid an interest as per the interest rate existing on the savings account. To open a fixed deposit, the application has to be submitted to the bank along with the PAN card, photograph and identity proof.

You Can Also Check Here For Hassle Free Banking

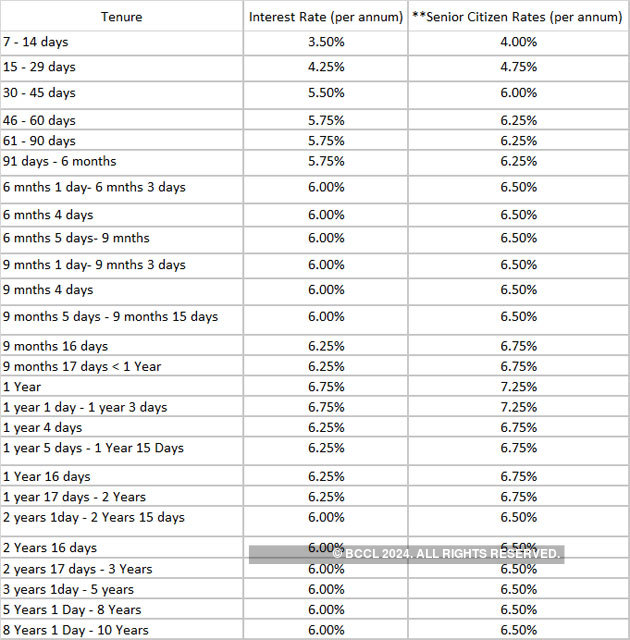

Canara Bank Deposits Interest Rates

The interest rate on the deposits is calculated monthly and is disbursed quarterly, half-yearly or annually as directed by the customer. The interest rate on fixed deposits is in the range of 5.50% to 6.90% depending on the tenure for which the deposit is made.

For senior citizens, the interest rate on fixed deposits is 0.5% more than that offered for other customers except for the deposits related to capital gains and NRO fixed deposits. The interest rate on the Canara Champ deposit scheme is that the interest is about 4% per annum. Along with Canara Bank some other banks like Dena Bank Deposits, Citi Bank Deposits and Yes Bank Deposits also provides the best interest rates to their customers.Are you looking for loans at low interest rates then Canara Bank Loans provides loans to their customers at low interest.

FAQ’s Related to Canara Bank Deposits

- What is the eligibility for opening a Canara Bank deposit for a minor?

2. What is the interest rate on fixed deposits for senior citizens?

3. What is the tenure for recurring deposit?