Chase Check Deposit

In general, Chase Bank branches are open from 9 a.m. To 6 p.m., Monday through Friday. Most locations are also open from 9 a.m. Chase Bank branches are typically closed on Sundays and federal holidays. You can also deposit a check through a Chase ATM — find your nearest ATM using the Chase ATM locator. Call Chase at 800-935-9935 and verify Login to your Chase online account, they should show your account number on your statements The spot for your account number on a Chase Deposit Slip.

- Texas Location: 14340 Torrey Chase Blvd, Ste 153, Houston, Texas 77014. Per Texas Administrative Code 7 TAC §80.200(b): CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A COMPANY OR A RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201.

- You can make check and cash deposits at virtually any Chase ATM 24 hours a day, 7 days a week. Use our locator to find an ATM or Chase branch.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Viewing check images

- Add money

- Checkbook orders

- Routing and account number

- Direct deposit

- View checks

- Overdraft Services

You can see images of checks you've written for up to three years online when you sign in to your account on chase.com.

Once a check has cleared, you can see an image of it when you sign in to your account on chase.com. By choosing the check icon next to the check number, you can:

- See and print an image of the check

- Zoom in to see every detail of the check

- Save the image as a PDF

If you have any questions about seeing or requesting checks, please call 1-800-935-9935.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Chase Mobile®Banking

Business banking at your fingertips

- Overview

- Mobile banking

- How to get started

- Mobile features

- Additional services

- FAQs

The Chase Mobile app is easy to use and offers security with encryption technology

Download the Chase Mobile app today

How to get started with mobile banking

Get the Chase Mobile app by texting “mobile” to 24273 for a link or find it in the app store.

Sign in with your Chase Business Online username and password. If you don’t already have a username and password, you can learn more.

Choose “Request an identification code” and how you’d like to get it. Enter the code and your password, then you’re done.

With the Chase Mobile app, you can:

- Manage alerts and paperless statements

- Pay bills or schedule when you want to pay bills

- Transfer money across the country

- Locate an ATM or branch near you

- Make a deposit with Chase QuickDepositSM

- Use Chase QuickPay® with Zelle® to get paid or send payments with just a U.S. mobile phone number or email address

Additional Business Banking Services

Check balances and transaction history with texting.

Delegate how employees can manage your online account, pay vendors or process payroll.

Chase Check Deposit Fee

Frequently Asked Questions

Learn more about Chase Mobile banking, text alerts and online banking with Chase.

Do I have to be enrolled in Chase Online to use the Chase Mobile® app?

Yes. However, you can enroll in Chase Online through chase.com or the Chase Mobile® app. You can use the ATM & branch locator, as well as access Chase contact information, without being enrolled in Chase Online.

What security features are in place to protect my account information on my phone?

Chase Check Deposit Availability

expandWe use 128-bit Secure Socket Layer (SSL) technology to encrypt your personal information such as usernames, passwords and account information. The Chase Mobile® app will decode any encrypted information we send you. We also use multifactor authentication that verifies that you own the accounts you want to access when you first sign in using the Chase Mobile® app. To do this, you’ll need to request an Identification Code, which you can receive by email, phone or text message.

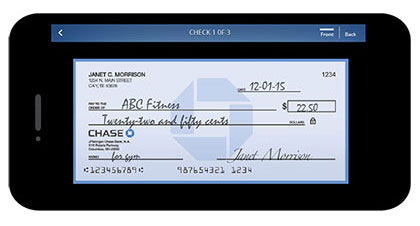

How do I use Chase Mobile® to deposit checks?

- Sign in through the Chase Mobile® app.

- Click “Deposit” on the menu.

- Choose the deposit account.

- Type in the check amount.

- Take pictures of the front and back of the check.

- Submit the deposit.

Chase Check Deposit Hold

Who can use the mobile devices to deposit checks?

Currently, the security administrator who signed up for Chase QuickDeposit can deposit checks. The security administrator can also give sub-users mobile access as well as the ability to make mobile deposits.

Are there deposit limits for the mobile device?

There are both daily and monthly maximum amounts that you may deposit to each eligible business or consumer account through an eligible mobile device. You'll see those limits when you initiate a deposit.

How do I know I can use my smartphone to deposit checks?

When you sign in to Chase Mobile, you’ll know you can use your smartphone to deposit checks if you see “Deposit” on the menu.